Impact of Rising Rate on the Housing Market

Given all the recent news on inflation, interest rates, and home prices, it looks like a good time for me to once again dust off my economics degree and share my own thoughts on what’s going on out there. I hope you find this helpful and feel free to get in touch with your thoughts and any questions you may have.

Some Historic Perspective

In recent weeks we have seen mortgage interest rates quickly double from historic lows around 2.5% to now over 5%. While still relatively low, percentage wise that is a large and rapid rise. But as is often the case, some historic perspective can be helpful…

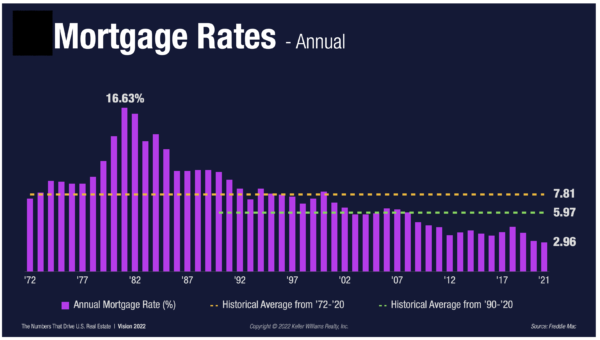

During the 1970’s, rates were mostly in the 7 – 8.5% range, briefly flirting with a high of 10% in 1974 then settling back down. Then in 1979, rates began a stratospheric rise and hit an historic high water mark of 16.63% just 2 years later. It took 4 years for them to finally get back to the 10% mark, a number they then hovered around for the next 5 years.

By 1990 rates began to slowly fall below the 10% mark, gradually declining from there for the next 30 years. That decline was accelerated during the financial crisis of 2008 pushing rates below 5% where they stayed, falling even further during the recent pandemic, finally hitting an all time low in the mid 2% range. Much of this has been driven by the Federal Reserve’s policies to help sure up the economy and the housing market during our recent uncertain times. The graph below nicely illustrates this trend through the beginning of this year (source: Gary Keller Vision Speech Presentation 2/22).

Back to Reality

But now as we move through 2022, inflation has spiked for various reasons – government stimulus during the pandemic, high consumer demand, supply chain challenges, oil shocks from the Russian invasion of Ukraine, etc. This has caused the Fed to reverse course, switching from pushing rates down to pushing rates up, hoping to cool demand. And mortgage rates are showing the impact of that policy by rapidly rising, a pattern that is likely to continue for some time. The question is how will it effect the housing market?

Rates and Home Prices

Rising rates can impact housing demand in two main ways

- Higher rates make house payments more expensive. For example, a $500K mortgage at 3% = $2,108. At 5%, it jumps to $2,685. That’s an increase of $577 a month (not calculating mortgage interest tax deduction).

- Any buyer who is trying for the maximum loan he/she can qualify for will find that maximum amount has gone down since more expensive house payments reduce the amount of money a bank will lend a buyer. That results in fewer buyers at any given price point and especially first time buyers.

Based on those two factors, we should expect housing demand to decline and therefore price increases to either slow down or perhaps stall out. That’s what the Fed is hoping for. Depending on how far and how fast rates rise, actual price decreases are not out of the question. Just keep in mind home sellers tend to resist price drops unless there is an urgent need to sell. So I’m not expecting any major price declines anytime soon.

But like in any good economic question, there are contrary factors to consider

- Homeowners that bought or refinanced recently and who enjoy low rate loans may choose to stay in their homes rather than sell and take the hit of a more expensive loan on a new home. That can result in lower inventory making our long standing inventory shortage even worse. Lower supply may counteract any drop in demand, keeping prices high.

- Buyers who have been on the sidelines may rush into the market or be more motivated, trying to lock in a mortgage soon before rates go even higher. More buyers equals increasing demand.

- Those that don’t buy are being hit with rising rents which have rebounded mightily from their COVID lows. So renters faced with a more expensive mortgage may still want to buy because the rental alternative is more expensive now too.

And of course there are all the general factors outside of the housing market that come into play as well – economic growth, consumer confidence, world affairs etc.

While we can argue the impact of rising rates in a number of ways, take another look at the historic rates graph. You’ll notice while rates have undoubtedly spiked over the past month or two, we are still below the 6% historic trend line of the last 30 years. And even further below the nearly 8% average of the past 50 years. So while 5+ interest rates seem rough after years of rates in the 3’s and pandemic driven 2’s, they seem less daunting in the long view.

So What Lies Ahead?

The Metro Boston and Newport/Coastal RI markets that I serve are certainly still very robust, with scarce inventory and high demand resulting in prices that continue to climb in many areas. And even in some areas where we see the number of sales declining, much of that is attributable to reduced inventory rather than reduced demand.

That said, we are perhaps starting to see the early effects of higher rates combined with sky high home prices. There have been reports of a slight drop in the number of properties sold with bidding wars for example. But the rise in interest rates is too recent to have any concrete data to analyze quite yet. So I’ll be watching closely and look forward to sharing more data in the coming months. In the meantime please don’t hesitate to contact me to discuss any questions you may have and your particular situation.

Ken